Individual Income Tax Return Frequently Asked Questions for more information. Individual Income Tax Return electronically with tax filing software to amend tax year 2019 or later Forms 1040 and 1040-SR.

Personal Tax Relief 2021 L Co Accountants

Coming back to the tax exemptions and reliefs these are all the ones that were announced by the government during the 2022 Budget speech.

. Also LHDN extended the dateline for extra 2 weeks. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. Please click Income Tax Rates for details about the.

Another benefit of this scheme is income tax relief. How Does Monthly Tax Deduction Work In Malaysia. Heres How A Tax Rebate Can Help You Reduce Your Tax Further.

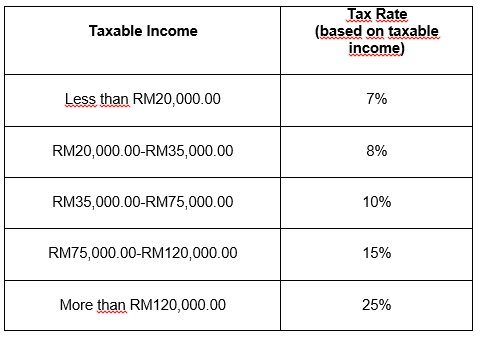

So the more taxable income you earn the higher the tax youll be paying. Resident individuals are eligible to claim tax rebates and tax reliefs. To fully utilize your income tax relief.

However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income will be reduced to RM34500. Automatic Individual Relief Claim allowed. RPGT Exemptions tax relief Good news.

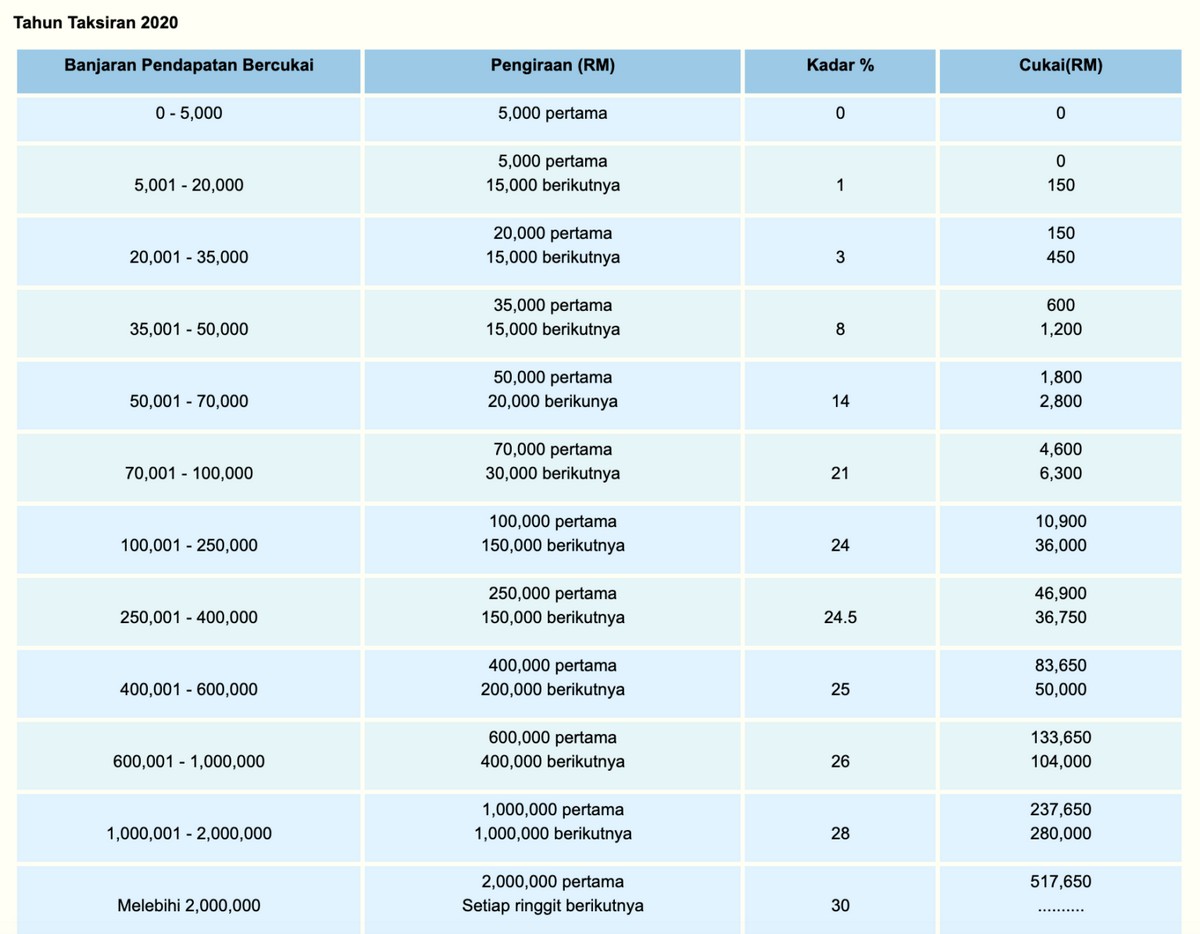

Income tax rates 2022 Malaysia. On the First 5000. With that heres LHDNs full list of tax reliefs for YA 2021.

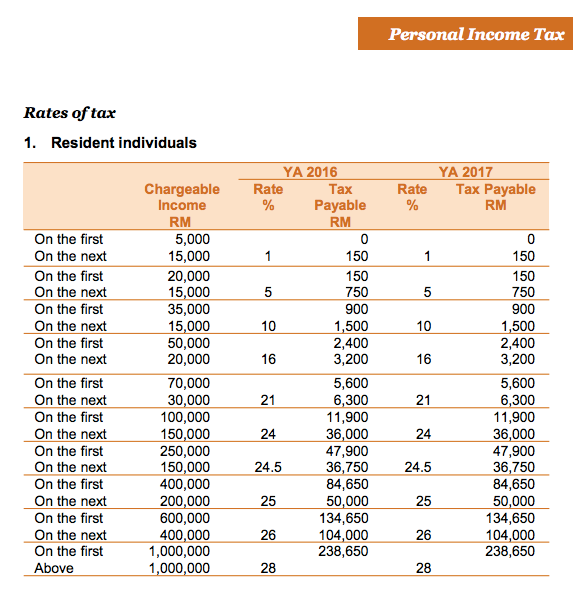

The tax year commonly called the year of assessment YA runs from January 1 to December 31. This category of education tax relief in Malaysia is only applicable to the individual themself. Per LHDNs website these are the tax rates for the 2021 tax year.

This relief is applicable for Year Assessment 2013 and 2015 only. On the First 5000 Next 15000. Income Tax Offences Fines and Penalties.

The most important thing is you will get a faster refund in case you paid excess income tax through PCB. Youll pay the RPTG over the net chargeable gain. Below are the Individual Personal income tax rates for the Year of Assessment 2021 provided by the The Inland Revenue Board IRB Lembaga Hasil Dalam Negeri LHDN Malaysia.

Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file. Basically the lower your income the lower your tax rate is and the less tax you will have to pay. Therefore by adding up your income from the various classes you can determine your tax rate.

Tax rules differ based on the tax residency of the individual. Income tax is assessed on a current-year basis. Calculations RM Rate TaxRM A.

Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to RM96000 annually. See Form 1040-X Amended US. If you owned the property for 12 years youll need to pay an RPGT of 5.

Self-employed may want to take advantage of the EPF tax relief. Tax on REIT Real Estate Investment Trusts Investment. For the 2021 assessment Malaysia IRB Inland Revenue Board is giving income tax relief of RM4000 for contribution to EPF and other approved schemes.

Penalty for Late Income Tax Payment. Your tax rate is calculated based on your taxable income. The current tax rate as announced under Budget 2020 starts from 0 and goes all the way up to 30.

Youre eligible for an automatic tax deduction of RM9000 just by filling in the LHDN e-Filing form. You can file Form 1040-X Amended US. Claiming these incentives can help you lower your tax rate and pay less in overall taxes.

There are some exemptions allowed for RPGT. Based on this amount your tax rate is 8 and the total income tax that you must pay amounts to RM1640 RM600 RM1040. Review Tax Rate Tax Exemption.

Self Parents and Spouses. Overpaid Taxes Can Be Refunded In The Form Of A Tax Return. Self parents and spouse 1.

The education tax relief for your children falls under Parenthood which we will cover below. Find Out Which Taxable Income Band You Are In. Guide To Using LHDN e-Filing To File Your Income Tax.

Tax payable Net Chargeble Gain X RPGT Rate based on holding period RM171000 X 5 RM8550. As an example lets say your annual taxable income is RM48000.

List Of Lhdn S Income Tax Relief For E Filing 2021 Ya 2020 Otosection

Cukai Pendapatan How To File Income Tax In Malaysia

Business Income Tax Malaysia Deadlines For 2021

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

Malaysia Personal Income Tax Relief 2021

10 Things To Know For Filing Income Tax In 2019 Mypf My

All Posts In The Month Of 2020

How To Declare Your Rental Income For Lhdn 2021 Speedhome Guide

Solved In Doing An Income Tax Calculation Lhdn Was Given Chegg Com

Lembaga Hasil Dalam Negeri Malaysia

Lhdn Irb Personal Income Tax Relief 2020

Income Tax Of An Individual Lembaga Hasil Dalam Negeri

Lhdn Officially Announced The Deadline For Filing Income Tax In 2021 Attached Is A Guide To Tax Filing Online Everydayonsales Com News

Filing Income Taxes In Malaysia Mystery Solved By Other Expats Medium

7 Tips To File Malaysian Income Tax For Beginners

Income Tax Relief For Lhdn E Filing 2022 Ya 2021 Joy N Escapade

File The Right Form And Be Aware Of Exemptions Taxpayers Told The Star

Malaysia Personal Income Tax Guide 2021 Ya 2020